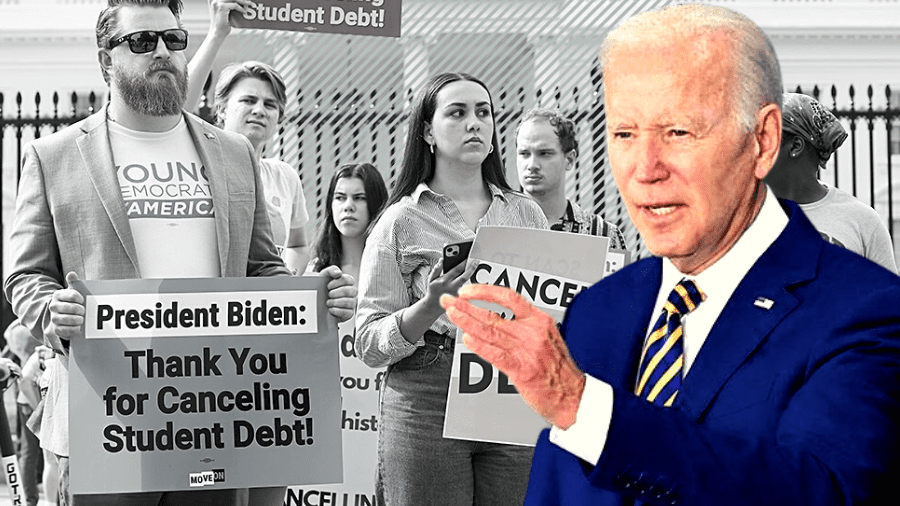

President Joe Biden has proposed a new plan for student loan forgiveness that could potentially provide relief for millions of Americans.

The plan, which is currently in the proposal stage, aims to address the student loan crisis in the United States by providing immediate relief for borrowers, increasing funding for Pell Grants, simplifying the application process for loan forgiveness, making community college free, and increasing accountability for colleges.

Read on for more details.

Everything You Need to know About the New Student Loan Plan

One of the key components of the Biden plan is the provision of immediate relief for borrowers. Under the proposal, borrowers with federally held student loans would have their payments temporarily suspended until September 30, 2021. This would provide much-needed relief for borrowers who have been struggling to make their loan payments during the pandemic. The suspension of payments would also give borrowers time to reassess their financial situation and make a plan for repaying their loans in the future.

Another important aspect of the Biden plan is the automatic forgiveness of loans for borrowers with low incomes. Under the proposal, borrowers who have an income-driven repayment plan and have been making payments for at least 20 years would have the remaining balance of their loans forgiven. This would provide automatic forgiveness for borrowers who have been making payments for a significant period of time and have a low income. This would be a significant relief for borrowers who have been struggling to repay their loans for decades and have not been able to make much progress in reducing the balance.

The Biden plan would also increase funding for Pell Grants, which provide need-based financial aid to low-income students. This would make college more affordable for students from disadvantaged backgrounds and would help to reduce the burden of student loans for these students. Additionally, the plan would make community college free, which would make college more affordable for students who may not be able to afford traditional four-year institutions.

In addition to providing relief for borrowers, the Biden plan also aims to simplify the application process for loan forgiveness and income-driven repayment plans. The proposal would streamline the process and make it easier for borrowers to apply for and receive the relief they need. This would be a significant improvement over the current system, which can be confusing and difficult for borrowers to navigate.

The Biden plan would also increase accountability for colleges by linking their federal funding to their students’ loan repayment rates. This would provide an incentive for colleges to help their students succeed and repay their loans. This would ensure that colleges are held responsible for their students’ loan outcomes and would help to reduce the burden of student loan debt for graduates.

Overall, the Biden student loan forgiveness plan is a comprehensive proposal that would provide much-needed relief for borrowers and make college more affordable for all students. The plan would provide immediate relief for borrowers, increase funding for Pell Grants, simplify the application process for loan forgiveness, make community college free, and increase accountability for colleges.

It’s important to note that the student loan forgiveness plan is still in the proposal stage and it’s uncertain if and when the plan will be passed or implemented. However, if passed, this plan would have a major impact on those borrowers who have federal student loan, as it would provide relief for millions of Americans who are struggling to repay their loans.

In conclusion, the student loan crisis in the United States is a significant problem that affects millions of Americans. The Biden student loan forgiveness plan is a step in the right direction to addressing this crisis by providing relief for borrowers, increasing funding for Pell Grants, simplifying the application process for loan forgiveness, making community college free and increasing accountability for colleges. This plan if passed, would bring much-needed relief for borrowers and make college more affordable for all students.

In its initial 2023 budget proposal, the Biden administration has proposed a significant increase in funding for the Federal Student Aid (FSA) program. The proposal calls for an increase of a third, or $2.65 billion, in the budget for FSA, which is the largest provider of student financial aid in the United States.

The proposed increase in funding for FSA is driven by a number of factors. Firstly, the White House recognizes that FSA will need more money in 2023 to keep up with routine loan management and to fulfill long-laid plans, some mandated by Congress, to improve the whole system. This includes efforts to streamline the loan repayment process, make college more affordable, and provide relief for borrowers who are struggling to repay their loans.

Secondly, the proposed increase in funding for FSA is also aimed at addressing the ongoing student loan crisis in the United States. The student loan debt in the country has reached a staggering $1.7 trillion, and many borrowers are struggling to repay their loans. The proposed increase in funding for FSA would provide much-needed relief for these borrowers and help to make college more affordable for students from disadvantaged backgrounds.

Thirdly, the proposed increase in funding for FSA is also aimed at addressing the disproportionate impact of the student loan crisis on marginalized communities. Student loan debt disproportionately affects people of color, low-income borrowers, and first-generation college students. The proposed increase in funding for FSA would help to reduce the burden of student loan debt on these communities and help to make college more accessible to all students.

In conclusion, the proposed increase in funding for FSA is a necessary step towards addressing the student loan crisis in the United States. The proposed increase in funding would provide much-needed relief for borrowers and help to make college more affordable for students from disadvantaged backgrounds. It would also help to address the disproportionate impact of the student loan crisis on marginalized communities and help to make college more accessible to all students.

Add Comment